|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Understanding Pet Insurance Prices: An In-Depth OverviewIn today's world, where our pets have become cherished members of the family, ensuring their health and well-being is paramount. Pet insurance has emerged as a crucial tool for pet owners, but the intricacies of its pricing can often seem bewildering. This article aims to untangle the complexities surrounding pet insurance prices, offering a comprehensive look into how they are determined and what factors influence them. At the core, pet insurance operates much like health insurance for humans, providing coverage for unforeseen medical expenses that can arise due to accidents, illnesses, or even routine check-ups. However, the price of pet insurance is not one-size-fits-all; it varies based on several key factors. Firstly, the breed of your pet plays a significant role in determining insurance costs. Certain breeds are predisposed to specific health conditions, which can drive up insurance premiums. For instance, larger breeds like Great Danes or Saint Bernards might face higher premiums due to their susceptibility to joint problems. Conversely, smaller breeds, while often less expensive, may be prone to dental issues, which can also affect pricing. Age is another critical determinant. Younger pets generally have lower premiums as they are less likely to encounter health issues compared to their older counterparts. As pets age, the likelihood of chronic conditions increases, often leading to higher premiums.

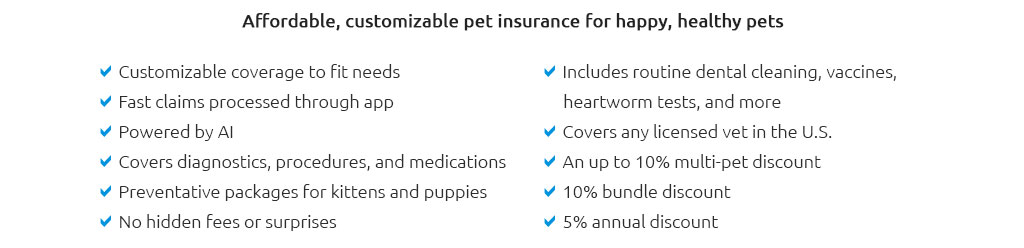

Moreover, some insurance companies offer customizable plans that allow pet owners to tailor coverage according to their needs and budget. Opting for a higher deductible can lower monthly premiums but may result in higher out-of-pocket expenses when making a claim. It's worth noting that while cost is a significant factor, it should not be the sole consideration when selecting pet insurance. The reputation of the insurance provider, their claim process, and customer service are equally important. In conclusion, while pet insurance prices may initially seem daunting, understanding the factors that influence them can empower pet owners to make informed decisions. Balancing cost with coverage is key to ensuring that our furry friends receive the best possible care without breaking the bank. In the end, investing in pet insurance is not just about covering potential medical expenses; it's about providing peace of mind and safeguarding the health of our beloved companions. https://www.usnews.com/insurance/pet-insurance

Its sample rates are $45.96 per month for a dog, and $22.66 per month for a cat. In addition to offering a range of coverages for dogs and cats, the company ... https://www.metlifepetinsurance.com/blog/pet-insurance/how-much-does-pet-insurance-cost/

As of 2024, the average monthly premium for dog insurance that covers accidents and illnesses has increased to $53 per month. https://www.pawlicy.com/

Pawlicy Advisor provides free quotes, comparison charts, and help from licensed agents to get you the best pet insurance for your breed at the lowest rate.

|